Forex spread Formula. The Forex spread is usually calculated as a percentage, and the formula for the forex spread cost calculator is given below. Spread % = ((Ask price – Bid price)/Ask price) X where for the specific deal. Ask price is the lowest price for which the dealer will sell currency units Forex experts explain what Spread is in Forex. A spread in Forex, simply defined, is the price difference between where a trader may BUY or SELL an instrument. A market maker determines these prices based on the prices he gets from the greater market. Traders that are familiar with equities will call this the Bid: Ask spread or bid and offer The spread is the difference between the ask price and the bid price. Your broker charges you commission for each trade in the form of spread. Look for brokers offering you

What is Spread in Forex

Investing in the forex markets involves trading one currency in exchange for another at a preset exchange rate. Therefore, currencies are quoted in terms of their price in another currency. The forex spread is the difference between the exchange rate that a forex broker sells a currency, and the rate at which the broker buys the currency.

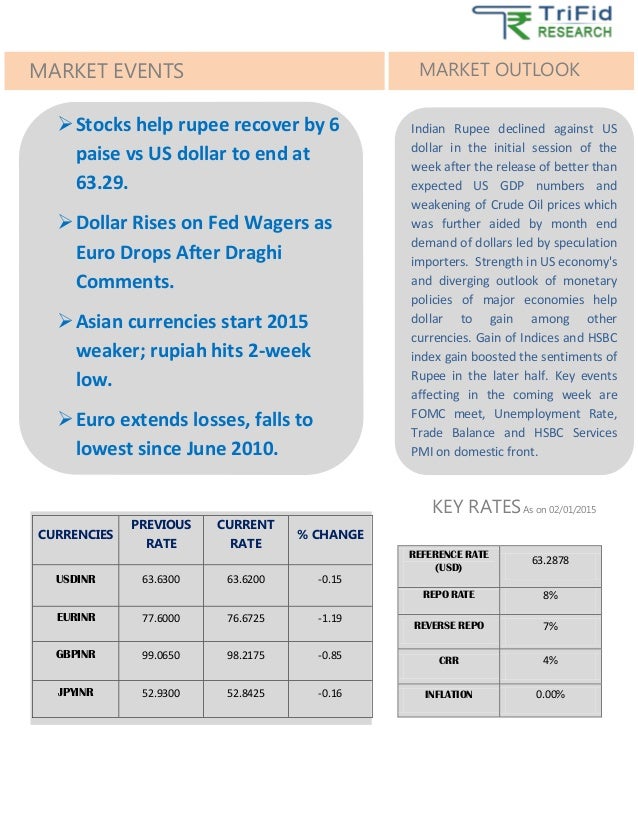

All of this trading activity impacts the demand for currencies, their exchange rates, and the forex spread. Forex trading or FX trading is the act of buying and selling currencies at their exchange rates in hopes that the exchange rate will move in the investor's favor. Traders can buy eurosin forex what is a spread example, in exchange for U.

dollars at the prevailing exchange rate—called the spot rate —and later, sell the euros to unwind the trade. The difference between the buy rate and the sell rate is the trader's gain or loss on the transaction.

Before exploring forex spreads on FX trades, it's important to first understand how currencies are quoted by FX brokers. Currencies are always quoted in pairs, such as the U. The USD would be the base currency, and the CAD would be the quote or counter currency. In other words, the rate is expressed in Canadian terms, meaning it costs 1. However, some currencies are expressed in U. dollar terms, meaning the USD is the quote currency. For example, the British pound to U.

dollar exchange rate of 1. The euro is also quoted as the base currency so that one euro at an exchange rate of 1. Now that we know how currencies are quoted in the marketplace let's look in forex what is a spread how we can calculate their spread. Forex quotes are always provided with bid and ask prices, similar to what you see in the equity markets.

The bid represents the price at which the forex market maker or broker is willing to buy the base currency USD, for example in exchange for the counter currency CAD. Conversely, the ask price is the price at which the forex broker is willing to sell the base currency in exchange for the counter currency. The bid-ask spread is the difference between in forex what is a spread price a broker buys and sells a currency.

So, if a customer initiates a sell trade with the broker, the bid price would be quoted. If the customer wants to initiate a buy trade, the ask price would be quoted. For example, let's say a U.

Spreads can be narrower or wider, depending on the currency involved. The spread might normally be one to five pips between the two prices. However, the spread can vary and change at a moment's notice given market conditions. Investors need to monitor a broker's spread since any speculative trade needs to cover or earn enough to cover the spread and any fees.

Also, each broker can add to their spread, which increases their profit per trade. A wider bid-ask spread means that a customer would pay more when buying and receive less when selling. In other words, each forex broker can charge a slightly different spread, which can add to the costs of forex transactions. Besides the broker, other factors can widen or narrow a forex spread. The time of the day that a trade is initiated is critical. European trading, in forex what is a spread, for example, in forex what is a spread, opens in the wee hours of the morning for U.

traders while Asia opens late at night for U. and European investors. If a euro trade is booked during the Asia trading session, the forex spread will likely be much wider and more costly than if the trade had been booked during the European session.

In other words, if it's not the normal trading session for the currency, there won't be many traders involved in that currency, causing a lack of liquidity. If the market isn't liquid, it means that the currency isn't easily bought and sold since there aren't enough market participants.

As a result, forex brokers widen their spreads to account for the risk of a loss if they can't get out of their position. Economic and geopolitical events can drive forex spreads wider as well. If the unemployment rate for the U. comes out much higher than anticipated, for example, the dollar against most currencies would likely weaken or lose value, in forex what is a spread.

The forex market can move abruptly and be in forex what is a spread volatile during periods when events are occurring. As a result, forex spreads can be extremely wide during events since exchange rates can fluctuate so wildly called extreme volatility.

Periods of event-driven volatility can be challenging for a forex broker to pin down the actual exchange rate, which leads them to charge a wider spread to account for the added risk of loss. Securities and Exchange Commission. Your Money. Personal Finance, in forex what is a spread. Your Practice. Popular Courses, in forex what is a spread. Table of Contents Expand. Understanding In forex what is a spread Trading, in forex what is a spread.

How Currencies Are Quoted. How the Spread Is Calculated. How Forex Spreads Are Quoted. Exogenous Events and Forex Spreads. Key Takeaways The forex spread is the difference between a forex broker's sell rate and buy rate when exchanging or trading currencies.

Spreads can be narrower or wider, depending on the currency involved, the time of day a trade is initiated, and economic conditions. Brokers can add to or widen their bid-ask spread, meaning an investor would pay more when buying and receive less when selling.

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Partner Links. Related Terms Currency Pair Definition A currency pair is the quotation of one currency against another. Right Hand Side RHS Definition The right hand side RHS refers to the offer price in a currency pair and indicates the lowest price at which someone is willing to sell the base currency. Direct Quote Definition A direct quote is a foreign exchange rate quoted as the domestic currency per unit of in forex what is a spread foreign currency.

ISO Currency Code Definition ISO currency codes are three-letter alphabetic codes that represent the various currencies used globally. Buy Quote A buy quote is one way of describing the best available price to buy a particular security at any given time throughout a trading session. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Lesson 6: What is a spread in forex?

, time: 6:43What is a Spread in Forex Trading? - blogger.com

Forex experts explain what Spread is in Forex. A spread in Forex, simply defined, is the price difference between where a trader may BUY or SELL an instrument. A market maker determines these prices based on the prices he gets from the greater market. Traders that are familiar with equities will call this the Bid: Ask spread or bid and offer 05/05/ · A spread in forex comprises two prices: the bid price (the buying price) and the ask price (the selling price). The bid price is what a forex broker is willing to pay for a currency, while the ask price is the rate at which a forex broker will sell the same currency A forex spread is the difference between the bid price and the ask price of a currency pair, and is usually measured in pips. Knowing what factors cause the spread to widen is crucial when trading forex. Major currency pairs are traded in high volumes so have a smaller spread, whereas exotic pairs will have a wider spread

No comments:

Post a Comment