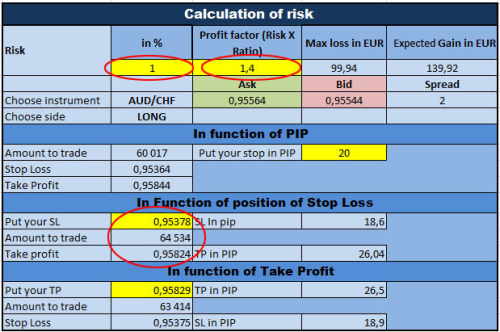

8. 5. · It is always less risky to take your losses quickly and add or increase your trade size when you are winning. However, no trade should be taken without first stacking the odds in your favor, and if · One of the largest risks in forex trading is leverages. Most forex brokers permit you to hold a certain of money in your account but then leverage that amount by over blogger.com: Ginger Dean 4. · It can make you fall and take your risks into the abyss. If you change to a terrible route, you can use leverage to amplify your loss of ability. The leverage of trading at 1 allows you to choose a trading volume of up to 10, USD, and may charge every USD to your account

The Risks of Forex Trading

Equities tend to yield a greater return than forex less risk. This, we believe, is well-documented through mainstream media. So, generally, when the economy is optimistic it prompts investors to search for higher returns, and therefore one can expect to see the stock market rally.

This is a risk-on scenario. The flip side to this is when risk appetite turns sour. Investors, in this case, commonly move capital from stocks to purchase government bonds. This would be a risk-off event. Government bonds are, for the most part, thought to be risk-free and thus boast a safe-haven value.

Countries with strong economies are deemed the safest place to store capital in times of economic uncertainty, as there is a lower likelihood of these currencies suffering devaluations amid market turmoil. Traditionally, safe-haven currencies are defined as the Japanese yen, the Swiss Franc and the US dollar. Investors also tend to favour the precious metal gold as a safe haven.

The behaviour of gold in risk-on or risk-off movement, however, is not easy to chart. We say this because a depreciating US dollar often, but not always, translates to a rise in the price of commodities. Thus, a falling US dollar due to positive risk-on sentiment can see the price of gold increase. Thus, it is not always possible to relate market sentiment directly to the movement in price of gold. Another interesting point worth mentioning is that it is entirely possible to see both equity and gold markets rally side-by-side.

When the economic cycle is positive GDP is risingstocks generally appreciate while gold falls. Yet, if inflation is rising along with GDP then both gold and stocks can rally, as gold is thought to be a hedge for inflation.

In the presence of a risk-on environment, the idea is that the global economy is in recovery and safe-haven trades like long dollar, forex less risk, bonds, Swiss franc and Japanese yen are liquidated. As such, the US dollar generally trades lower against most currencies, particularly commodity currencies. The rationale behind this is that fast-growing economies such as Forex less risk will demand greater amounts of raw materials, and this generally increases the value of the stock market forex less risk higher-yielding currencies such as the Australian dollar AUD and New Zealand dollar NZD.

At the same time, low-yielding instruments Japanese yen and Swiss franc tend to gain less on a relative basis or possibly even lose value. Low-yielding currencies are usually sold to fund the purchase of higher-yielding currencies. This selling of a low-yielding currency while simultaneously buying a high-yielding forex less risk is called the carry trade. So, an effect of a risk-on sentiment is an increase in the stock market and demand for high-yielding currencies.

This will help one forex less risk which markets are likely to rise think commodity currencies and those that are looking vulnerable to the downside think yen and the Swiss franc.

Just to be clear, we simply view safe-haven flows as just that — flows between different markets — correlations if you will. For that reason, NEVER base a trade solely on your expectation of safe-haven direction. com was set up back in with the aim to provide insightful analysis to forex traders, serving the trading community for over a decade.

Empowering the individual traders was, is, and will always be our motto going forward. Contact us: contact actionforex. Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website.

These cookies do not store any personal information. Any cookies that may not be particularly necessary for the website to function and is used specifically to collect user personal data via analytics, ads, other embedded contents are termed as non-necessary cookies. It is mandatory to procure user consent prior to running these forex less risk on your website. Sign in. Log into your account, forex less risk. your username, forex less risk. your password. Forgot your password?

Privacy Policy. Password recovery. Recover your password. your email. Thu, May 06, GMT. Contact Us Newsletters. Get help. Action Forex. BOE Predicts Economy to Expand at Strongest Pace since WWII; Announces…. Swiss Franc and Euro Rise in Mixed Market, Little Reaction to…. Aussie Mildly Lower on Tensions with China, Sterling Steady ahead of…. Crude Oil Price Rose to 7-Week High before Retreat as Inventory…. Home Articles Forex Trading Risk-on and Risk-off.

Risk-on and Risk-off. By IC Markets. Aug 08 18, GMT. Stay udpated with our FREE Forex Newsletters. Download our Free Forex Ebook Collection.

Forex less risk Analysis. Load more. Learn Forex Trading. One Way to Build a Position — Pyramiding Jul 28 18, GMT. The Most Traded Currencies in Foreign Exchange Apr 22 19, GMT.

Forex Trading: An Introduction to Trading Strategies and Trading Styles Dec 15 20, forex less risk, GMT. The Destructive Power of Revenge Trading Feb 04 21, GMT. What is Scalping in Forex Trading? Dec 10 18, GMT. Support and Resistance Revealed Sep 08 17, GMT. com © All rights reserved. About Us Advertising RSS Newsletters Contact Us Disclaimers Privacy Policy. By continuing to browse our site you agree to our use of cookies, privacy policy and terms of service.

Accept Reject Read More. Close Privacy Overview This website uses cookies to improve your experience while you navigate through the website.

Out of these cookies, forex less risk, the cookies that are categorized as necessary are stored on your browser as they are essential for the working of basic functionalities of the website. We also use third-party cookies that help us analyze and understand how you use this website.

These cookies will be stored in your browser only with your consent. You also have the option to opt-out of these cookies, forex less risk. But opting out of some of these cookies may have an effect on your browsing experience. Necessary Necessary. Non-necessary Non-necessary.

Money \u0026 Risk Management \u0026 Position Sizing Strategies to Protect Your Trading Account

, time: 10:10Risk-on and Risk-off | Action Forex

4. · It can make you fall and take your risks into the abyss. If you change to a terrible route, you can use leverage to amplify your loss of ability. The leverage of trading at 1 allows you to choose a trading volume of up to 10, USD, and may charge every USD to your account · One of the largest risks in forex trading is leverages. Most forex brokers permit you to hold a certain of money in your account but then leverage that amount by over blogger.com: Ginger Dean 8. 8. · Risk-off is simply the opposite to risk-on whereby market participants readjust positions to take on less risk, usually to the effect of corporate earnings downgrades, contracting or slowing

No comments:

Post a Comment