11/12/ · The foreign exchange market (dubbed forex or FX) is the market for exchanging foreign currencies. Forex is the largest market in the world, and the trades that happen in it Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. A “ lot” is a unit measuring a transaction amount. When you place orders on your trading platform, orders are placed in sizes quoted in lots 2/26/ · Forex trading as it relates to retail traders (like you and I) is the speculation on the price of one currency against another. For example, if you think the euro is going to rise against the U.S. dollar, you can buy the EURUSD currency pair low and then (hopefully) sell it at a higher price to make a profit

What Is Forex Trading? – Forbes Advisor

The price at which the market is prepared to sell a product. The Ask price is also known as the Offer, forex into meaning. In FX trading, the Ask represents the price at which a trader can buy the base currency, shown to the left in a currency pair. In CFD trading, forex into meaning, the Ask also represents the price at which a trader can buy the product. For example, in the quote for UK OIL A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar.

Typically these times are associated with market volatility. The regular fixes are as follows all times NY :. In CFD trading, the Ask represents the price a trader can buy the product. A rollover is the simultaneous closing of an open position for today's value date and the opening of the same position for the next day's value date at a price reflecting the interest rate differential between the two currencies.

In the spot forex market, trades must be settled in two business days. For example, if a trader forex into meaningEuros on Tuesday, then the trader must deliverEuros on Thursday, unless the position is rolled over.

As a service to customers, forex into meaning, all open forex positions at the end of the day PM New York time are automatically rolled over to the next settlement date. The rollover adjustment is simply the accounting of the cost-of-carry on a day-to-day basis. Learn more about FOREX. com's rollover policy. Your form is being processed. A Accrual The apportionment of premiums and discounts on forward exchange transactions that relate directly to deposit swap interest arbitrage deals, over the period of each deal.

Adjustment Official action normally occasioned by a change either in the internal economic policies to correct a payment imbalance or in the official currency rate.

Analyst A financial professional who has expertise in evaluating investments and puts together buy, sell and hold recommendations for clients. Appreciation A product is said to 'appreciate' when it strengthens in price in response to market demand. Arbitrage The simultaneous purchase or sale of a financial product in order to take advantage of small price differentials between markets.

Asian central banks Refers to the central banks or monetary authorities of Asian countries. These institutions have been increasingly active in major currencies as they manage growing pools of foreign currency reserves arising from trade surpluses, forex into meaning. Their market interest can be substantial and influence currency direction in the short-term. Asian session — GMT. Ask offer price The price at which the market is prepared to sell a product. At or better An instruction given to a dealer to buy or sell at a specific price or better.

AUS A term for the Australian Securities Exchange ASXwhich is an index of the top companies by market capitalization listed on the Australian stock exchange. Dollar pair. Also "Oz" forex into meaning "Ozzie". B Balance of trade The value of a country's exports minus its imports.

Bar chart A type of chart which consists of four significant points: the high and the low prices, which form the vertical bar; the opening price, which is marked with a horizontal line to the left of the bar; and the closing price, which is marked with a horizontal line to the right of the bar. Barrier level A certain price of great importance included in the structure of a Barrier Option.

If a Barrier Level price is reached, the terms of a specific Barrier Forex into meaning call for a series of events forex into meaning occur. Barrier option Any number of different option structures such as knock-in, knock-out, no touch, forex into meaning, double-no-touch-DNT that attaches great importance to a specific price trading.

In a no-touch barrier, a large defined payout is awarded to the buyer of the option by the seller if the strike price is not 'touched' before expiry. This creates an incentive for the option seller to drive prices through the strike level and creates an incentive for the option buyer to defend the strike level. Base currency The first currency in a currency pair. It shows how much the base currency is worth as measured against the second currency. The primary exceptions to this rule are the British pound, forex into meaning, the euro and the Australian dollar.

Base rate The lending rate of the central bank of forex into meaning given country. Basing A chart pattern used in technical analysis that shows when demand and supply of a product are almost equal. It results in a narrow trading range and the merging of support and resistance levels. Basis point A unit of measurement used to describe the minimum change in the price of a product, forex into meaning. Bears Traders who expect prices to decline and may be holding short positions.

Bid price The price at which the market is prepared to buy a product. In FX trading, the Bid represents the price at which a trader can sell forex into meaning base currency, shown to the left in a currency pair. In CFD trading, the Bid also represents the price at which a trader can sell the product.

If the price moves by 1. BIS The Bank for International Settlements located in Basel, Switzerland, is the central bank for central banks. The BIS frequently acts as the market intermediary between national central banks and the market. The BIS has become increasingly active as central banks have increased their currency reserve management.

When the BIS is reported to be buying or selling at a level, it is usually for a central bank and thus the amounts can be large. The BIS is used to avoid markets mistaking buying or selling interest for official government intervention. Black box The term used for systematic, model-based or technical traders. Blow off The upside equivalent of capitulation. When shorts throw in the towel and cover any remaining short positions. BOC Bank forex into meaning Canada, the central bank of Canada.

BOE Bank of England, the central bank of the UK. BOJ Bank of Japan, the central bank of Japan. Bollinger bands A tool used by technical analysts, forex into meaning. A band plotted two standard deviations on either side of a simple moving average, which often indicates support and resistance levels.

Bond A name for debt which is issued for a specified period of time. Book In a professional trading environment, a book is the summary of a trader's or desk's total positions. British Retail Consortium BRC shop price index A British measure of the rate of inflation at various surveyed retailers. This index only looks at price changes in goods purchased in retail outlets. Broker An individual or firm that acts as an intermediary, bringing buyers and sellers together for a fee or commission.

In contrast, a dealer commits capital and takes one side of a position, hoping to earn a spread profit by closing out the position in a subsequent trade with another party. Buck Market slang for one million units of a dollar-based currency pair, or for the US dollar in general. Bulls Traders who expect prices to rise and who may be holding long positions, forex into meaning.

Bundesbank Germany's central bank. Buy Taking a long position on a product. Cable earned its nickname because the rate was originally transmitted to the US via a transatlantic cable beginning in the mid s when the GBP was the currency of international trade.

CAD The Canadian dollar, also known as Loonie or Funds. Call option A currency trade which exploits the interest rate difference between two countries. By selling a currency with a low rate of interest and buying a currency with a high forex into meaning of interest, the trader will receive the interest difference between the two countries while this trade is open.

Canadian Ivey Purchasing Managers CIPM index A monthly gauge of Canadian business sentiment issued by the Richard Ivey Business School. Candlestick chart A chart that indicates the trading range for the day as well as the opening and closing price. If the open price is higher than the close price, forex into meaning, the rectangle between the open and close price is shaded.

If the close price is higher than the open price, that area of the chart is not shaded. Capitulation A point forex into meaning the end of an extreme trend when traders who are holding losing positions exit those positions. This usually signals that the expected reversal is just around the corner. Forex into meaning trade A trading strategy that captures the difference in the interest rates earned from being long forex into meaning currency that pays a relatively high interest rate and short another currency that pays a lower interest rate.

NZD is the high yielder and JPY is the low yielder. Cash market The market in the actual underlying markets forex into meaning which a derivatives contract is based. Cash price The price of a product for instant delivery; i. CBs Abbreviation referring to central banks. Central bank A government or quasi-governmental organization that manages a country's monetary policy.

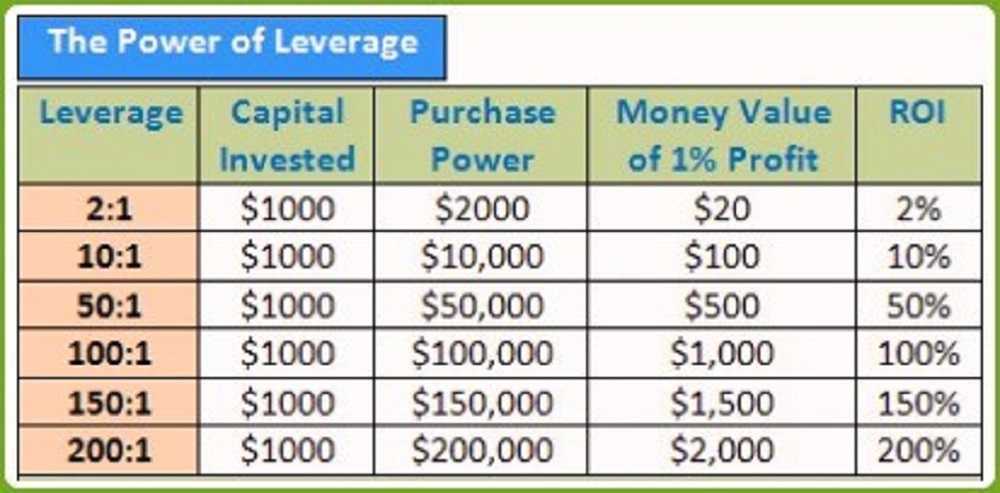

For example, the US central bank is the Federal Reserve and the German central bank is the Bundesbank. It allows traders to leverage their capital by trading notional amounts far higher than the money in their account and provides all the benefits of trading securities, forex into meaning, without actually owning the product.

Chartist An individual, also known as a technical trader, who uses charts and graphs and interprets historical data to find trends and predict future movements. Choppy Short-lived price moves with limited follow-through that are not conducive to aggressive trading.

Cleared funds Funds that are freely available, sent in to settle a trade. Clearing The process of settling a trade. Closed position Exposure to a financial contract, such as currency, that no longer exists, forex into meaning. A position is closed by placing an equal and opposite deal to offset forex into meaning open position. Once closed, a position is considered squared, forex into meaning. Closing The process of stopping closing a live trade by executing a trade that is the exact opposite of the open trade.

Intoduction to Forex Trading - FX trading - Basic to forex trading --

, time: 13:09What is a Lot in Forex? - blogger.com

Forex is a portmanteau of foreign currency and exchange. Foreign exchange is the process of changing one currency into another currency for a variety of reasons, usually for commerce, trading, or Official action normally occasioned by a change either in the internal economic policies to correct a payment imbalance or in the official currency rate 2/26/ · Forex trading as it relates to retail traders (like you and I) is the speculation on the price of one currency against another. For example, if you think the euro is going to rise against the U.S. dollar, you can buy the EURUSD currency pair low and then (hopefully) sell it at a higher price to make a profit

No comments:

Post a Comment